S&P 500 2732.22 +1.02.

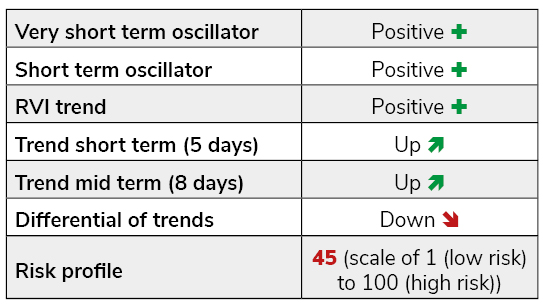

Over the last week, the S&P 500 reached, at least, an intermediate bottom in the low 2500, an objective we mentionned in our last comment (2532 on the 9th of February) before rebounding in a kind of V shaped move touching Fibonnaci retracement on the S&P 500 and the Nasdaq Composite Index last Friday. We are of the opinion that a large trading range is going to be set up over the next few weeks and even months, confusing bulls and bears but providing opportunities for traders. Our global risk profile stands around the neutral level but hasn’t reached an extreme during the downmove, the speed of the fall certainly didn’t let enough time to schock market participants. Last week, investors and traders were eager to jump into the market, taking advantage of cheap prices; the bullish consensus among private investors reached again a level that is close to the January top, which is disturbing as we would expect more cautiousness at this stage of the cycle.