S&P 500 2531,94 +84,05.

We wish our faithful readers a happy and prosperous new year 2019.

2018 has been a challenging year in the markets with swift, hectic and volatile up and downmoves. Our methodic and cautious approach bore fruit as our trading account based on "Market pulse" yielded a 12% return net of fees.

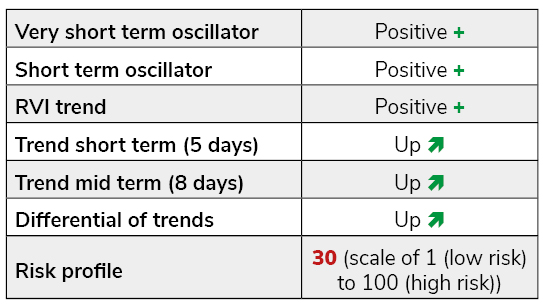

The Christmas period didn't let investors and traders enjoying their holidays as volatility hit its peak of the year. Finally, we observed the 21st and the 24th of December signs of capitulation, as measured by our fear/greed index and our capitulation index. Our global risk index reached the low 20's, a reading usually associated with bottoms. There is a good chance that the bulk of the downfall is behind us and that the market has reached a bottom. We mentionned several times during the fall the importance we attach to the internal momentum and recently the global adavance/decline line has shown signs of revival. Sentiment indicators are also positive as there is a great deal of skepticism among various market participants. The market may be in a position to climb back a wall of worry, a good sign.

Friday’s activity has been characterized by a lot of short covering, many systematic trading strategies my have have been caught by surprise and forced to run behind prices. This appears clearly in readings recorded by our buying/selling index and our capitulation index.